-

It was getting dark, and starting to rain. You needed a place to stay. Not just for the night, but a place to call your own after living under other people’s roofs for so long. You’re tired of moving, tired of the journey. You want to put down roots.

By strange coincidence, a stranger approaches you and says “See that house over there? I’ll sell you the house and the property it’s on for $50K.” You have the money, you’ve saved up for a long time. You agree.

“There’s just one or two more things,” says the stranger. “You can’t make significant modifications to the property without asking me first.” It seems reasonable, so you agree. “Any large-scale projects you wish to do on the property must be cleared by me,” stated the stranger. “And lastly, at any point, if I ever need the property for something, I can take it back from you, and if I do this I will pay market value…but you cannot refuse.” It struck you as odd, but you agree and buy the property.

Do you own it?

Property ownership in the United States…

…is a myth. Nobody owns (land/”real”) property. What people own is a title of use of property, but the property itself is jointly owned between cities, counties, states, and the nation. I’ve had this argument several times with many people, and none of them can reconcile “ownership” with the fact that:

- You often need to get government approval to modify an existing structure on property

- You need government approval for large-scale projects on property (building any kind of large structure, digging a mine, etc)

- Most importantly, the government can take your property away from you via Eminent Domain whenever it deems it necessary (you being compensated is irrelevant to the fact that you have no choice)

You do not own the property you “own” but rather own a title of use, and that title comes with various restrictions. If you can prove me wrong, please feel free to comment below, but to my understanding, if someone gives you something but has the ability to take it away from you at any point, you do not own it.

It gets interesting with things like a civil suit in which being on the losing end means some amount of your assets being seized. Did you own those assets to begin with? It’s an interesting question, but ultimately I would say you did own those assets, but through some form of wrongdoing via your own action/inaction lost access to them, via some socially-mandated set of rules that come along with social or economic interaction with other people.

That said, the fact that you can lose your property without wrongdoing and just because the government wants it, to me, points to the fact that the property was not yours to begin with.

Why does this matter?

This matters because given that property is not owned individually, it follows that property is socialized. In the context of a market system, it means that when you buy/sell property, you’re really just selling the title for use of the property, not the property itself.

So when talking about socialization of productive property or housing, nothing regarding ownership changes materially: the ownership of property is already socialized! What changes is the mediation of the use of property. What this mediation looks like without markets and how it works is another very interesting but complex set of ideas (which are outside the scope of this post).

However, the next time someone says that socialization of property is totalitarian or “doesn’t work” or some such nonsense, tell them that all property is already socialized and ownership is a myth.

-

As an opening note, I’d like to mention that while I came to the conclusions discussed in this post while researching what a “socialist mode of production” would look like, I’m attempting to the best of my abilities to not argue for one system or another. Rather, my goal is to share my findings on how economics can be broken down.

It was December 2018. I had recently read through a forum discussion about Universal Basic Income, an idea I supported at the time. One of the comments mentioned how socialists view UBI as a band-aid fix.

“Wait,” I thought. “Isn’t UBI a form of socialism?” I realized that even though my past 18 year old self had donned the label anarcho-communist, I didn’t actually know what that meant, other than “things should, like, be more equal.” I had left anarcho-communism behind in my 20s when I came to the realization that capitalism does work and became a supporter of it. But for some reason, when this last December rolled by, I connected with my old self again. You see, I have a problem. An addiction. I need to know how things work. It’s why I know a several forms of assembly language. It’s why I have a drawer full of deconstructed electronic components. I can remember my dad tell me as a kid: “Don’t take this apart!”. And now I needed to know what socialism meant; to deconstruct it and understand it. In our culture, the things we most attribute to socialism (state capitalism and welfare capitalism) have nothing to do with socialism. So what is it?

Then it started. A strange manic episode which seemed to come from nowhere. For weeks, I was waking up after only four or five hours of sleep. I would open my eyes, the sky would still be dark, and I was exhausted, but my head was racing. I used my early mornings to my advantage: reading papers, researching economic theory, architecting systems, thinking through methods and incentives. I swam through ideas like I had woken up at the bottom of a lake and needed air: libertarian socialism, central planning, free association, market socialism, common ownership, democratic socialism, communism, syndicalism, social dividends, collectivist anarchism. Marx, Kropotkin, Cockshott. USSR, China, Cuba, South America, the Spanish Civil War. A raging torrent of information, history, and theory. I found a subreddit where people argue bitterly about economics. I talked with people and I fought with people, socialists and capitalists alike. I formed opinions. I talked more. I fought more. I asked questions. I reshaped all my opinions. Then I did it all again.

The whole time, I was working on a project that would be the ultimate conclusion of my findings (which I will publish at a later date). This work has ushered me into a deeper understanding of how things are organized and how the pieces of economics all fit together.

The five components of economic systems

I ultimately found that there are five main components that describe an economic system. Because these are not apparently obvious, I thought it would be helpful to document my observations:

- Ownership. This is the crux of the capitalism vs socialism debate. Capitalism necessitates private ownership of the means of production. Socialism is the social ownership thereof. This means capitalism simpler: anything can be privately owned. Socialism is a bit more complicated, because it makes a distinction between private property (factories and stuff) and personal property (your hat, your Roomba, your toothbrush). This distinction is lost on many people (aka the “you want to take my toothbrush” problem).

- Organization. Is the economy completely decentralized and self-organizing? Or is there one entity that plans every input and output down to meticulous detail? It’s important to note that the former is attributed to capitalism, and the latter to socialism. This is mainly because most Marxist-Leninist states employed central planning for their economic system. But central planning is not socialism…social ownership of productive property is. It’s possible to have privately-owned production with heavy central planning (for instance, Nazi Germany). It’s possible, in theory, to have socially-owned productive instruments with a small (or no) government. We also have central planning in the United States (NASA, farm subsidies, etc).

- Costs/valuation. Valuation can be done with prices guided by market forces, which is the mode we’re all used to because it’s how capitalism does things. However, there are more methods of valuation. There’s the Marxian value theory in which a thing is valued at the average amount of labor it took to build it. There is in-kind valuation, where all possible aspects of costs are tracked for a particular item (for instance, the labor that went into it, how much of each raw material, externalities if possible, etc). It’s important to note that cost and value are different: there is some intersection between the two, but value might ignore a cost like pollution, and cost might not take into account how something is valued to a particular individual.

- Exchange. What medium do productive entities use to exchange? Money is the most prevalent one. There are other ideas, though, such as the free association of producers, where exchange happens freely…producers order things from other producers in order to meet some social need. If using central planning, exchange would look like an internal transfer might look at a large corporation.

- Distribution. Who gets what? If using a money system, those with money buy what they want. If using gift economics, distribution might be a function of reputation. If labor vouchers, distribution is a function of hours worked (and possibly the social value of that labor). In some systems, distribution is need-based (“to each according to their needs”…I realize this is loosely defined). Distribution could be ration based as well: each person gets a daily allowance of resources they can consume. It’s important to note that the distribution mechanism is also what puts downward pressure on resource consumption and incentivizes higher levels of efficiency in the productive process: producers must make things in such a way that those who want those things can afford them.

In theory, some of these parts can be swapped out for another. Also, few of these categories are binary: you can have some mix of public/private ownership, or some mix of decentralized/central planning. However, note that money can be used in a number of these economic components. This is a beautiful selling point of moneyed capitalism, but also what makes it hard to pick the above concepts apart: it’s simple. Anyone can own anything, and valuation/exchange/distribution are all based on money.

Also, notice we’re missing the authoritarian aspect here completely. This is on purpose. Economics and authoritarianism are completely separate topics, as much as people like to lump them in together. It’s possible to have a totalitarian government with privately-owned production. It’s possible to have a tiny government with social ownership of production.

Let’s clarify some ideas.

Ownership

I’d like to talk about the concept of ownership. I think it’s important to mention because it’s a deep topic of debate between proponents of socialism. What does it mean to have “common ownership over the means of production?” What even are the “means of production?”

For the productive instruments to be socially owned, there are a number of different ideas. First, the most common understanding is state ownership. This is tricky, though. If the state is representative of the people in it, then by the state owning the means of production, the people do as well. However, if a state is authoritarian such that the citizens have very little control, then the productive instruments are not held in common, but rather owned by oligarchs. This is in contrast with more anarchist ideas, in which ownership of means of production is directly social, as in, not proxied through a state (or perhaps, in the libertarian case, owned by a municipality) and use thereof is determined cooperatively.

Then, there’s the “means of production” themselves. There are as many definitions of this as there are socialists, but one common theme I’ve seen over and over would be large capital assets: raw materials/resources, productive land (farms), factories, warehouses, office buildings, air/sea ports, large machinery, and intellectual property. Essentially, anything that’s used exclusively for productive purposes would be a target for social ownership. It would be possible to socialize laptops and toothbrushes and things of that nature, but it likely would not be very effective at all.

Lastly, let’s talk companies themselves. Socialism necessitates abolishing private ownership of companies. What does this mean, though? Does the state own all companies? Do the employees? The answer is it depends. In some models (such as central planning), yes, the state would own, or at least orchestrate, all companies. In other systems, companies would be self-determined and would be state-agnostic. It’s important to note that just because the means of production are socialized doesn’t mean that the companies using those means of production need to be socialized as well.

Organization

Another important topic is how the economy is organized. It’s often thought that decentralized organization cannot work without prices/profits. I’d like to demonstrate that as theoretically false.

If you have a transparent system that allows orders between productive entities (for instance, some kind of blockchain), demand can be measured directly by looking at the order list. Instead of, then, using price signals to determine supply levels, supply can be matched directly to demand.

In other words, money is a method of exchange between productive entities, but it’s not the only method of exchange. Organization is as much about communication of needs as it is about a means of exchange: if needs can be communicated directly, then distributed production can be enabled, no matter what valuation system (or system of exchange) is used.

That wraps things up. I hope reading this was as illuminating to you as it was for me to discover it.

-

201904.02

The mystification of pricing

Pricing is an important economic tool. How much things cost, and how much things should cost, has been a subject of debate between economists for a long time. However, there’s one part of pricing I’d like to dissect. It’s the aspect of mystification.

When I buy a product, it sends a signal. It’s essentially an economic feedback mechanism that says “I value this product as much or more than the price that it is being sold for.” This signal is transmitted back to the producer (sometimes over many hops of the economic network because usually you buy a product from a distributor, not directly from the manufacturer). However, the producer does not know why I bought it.

The price takes into account many different factors: the inputs to production required to make the product, the wages of the people producing it, the marketing budget to convince people to buy it, the costs of compliance with regulations, the need to pay back interest on loans acquired for startup capital, shipping costs, etc etc. There are likely thousands upon thousands of factors that are bundled into the price of a product.

The problem is, we don’t know what they are. When I buy something, I am saying “I like this for some reason” and that’s the only economic signal the producer receives. I can call them and say “Hey, I love your peanut butter because it tastes better than others” and companies will certainly encourage this, but there is no economic feedback mechanism other than the purchase itself.

So, if labor costs $5, the inputs to production cost $3, marketing is $1, and the owner of the company wants a profit of $3, that’s

5 + 3 + 1 + 3 = 12. Now, as a consumer, how do I tell how much the labor cost for this product? Or how much profit was made? It’s impossible. You can only find one by knowing all of the others.Why is this a problem? It’s a problem because people encourage voting with capital. They encourage spending based on beliefs. But, there’s no economic feedback mechanism in place to vote for just one of the factors of the price of a product.

Imagine if you had deconstructed pricing for every product. Instead of $5.99 it had $0.03 in environmental compliance, $0.50 in marketing, $1.00 in wages (with a breakdown of labor-hours averaged per-worker), $0.60 in productive inputs (and each input had a deconstructed price as well), $1.67 in equipment maintenance, $0.98 for reinvestment in the company, and $1.21 in profit for the owners.

Now, pricing is demystified. You can buy a product produced by people who are paid well, or buy products that are made from products made by people who are paid well. You can buy a product that spends more in order to care for the environment. You can buy products that value profit less.

Would this not be a a requirement of voting with your dollar?

This thought experiment came out of discussions I’ve have around an economic model I’m working on. One of the ideas I’m interested in is wages being decided democratically based on a set of attributes: social need, skill/training required, stress level, danger, etc. Essentially, each attribute would be a value between 0 and 1, and the average of all the attribute values multiplied by a maximum wage would be someone’s hourly wage. A productivity attribute could be applied to each person such that their occupational wage goes from being fixed to being a range instead, and this productivity rate would be decided by the worker (if self-employed) or the members of their company. The wage attributes would be decided regionally (per-city/county).

In essence, you give every industry-occupation pair a score and use it to determine the range of wages a person can have. After that, you let the pricing system take over. The purpose here is for society to make a conscious decision on “what this job is worth.” My theory is that the economy would be shaped very differently if people were given a direct choice. Want smarter children? Raise the need for the education industry and for the teacher occupation. Too many tech dorks on scooters? Lower the social need for computer programmers. Making wages a conscious decision of the members of the community allows them to shape their own economy, without having to deal with the wildly inaccurate pricing system and the feedback loops of the market.

Should a pro football player be paid 500x more than a teacher? I’m willing to bet that if you asked every single person in the United States this question, the answer would overwhelmingly be “no.” Why, then, does the market enforce these patterns?

After discussions, this idea of democratically setting wages was met with some resistance. It was argued that the market already does allow democratization of wages. People do vote for salaries already, and they do it via the products and services they buy. However, after some thinking, I realized this isn’t true. People certainly enforce economic patterns via their spending, but the truth is that, even if they did want to alter their spending to shape the economy according to their desires, they simply do not have the information they need to do so.

This is because of the mystification of pricing.

UPDATE - Feb 12, 2020

It’s important to note that I’ve since abandoned the idea of democratically-decided wages. While the idea was made in good faith, I couldn’t solve for things like

- On call/emergency hour rate hikes. Sure, my day rate is $100/hr, but if you need me at 3am on the weekend, it’s $200/hr

- Scale. What does a musician make for performing gigs? What if they are playing shows for 1000+ people?

- Distributed decision making. My skills might be highly valued, and forcing a wage on someone when their time is worth more (both to them and the other party) is needlessly authoritarian. Shouldn’t the level of stress, danger, need, training, etc be decided by me and not the general population, who knows jack shit about my job?

I believe all of the problems that might be solved by democratic wages would actually be better handled by democratic workspaces (worker-owned companies) and free association. Not only that, but an excessive amount of beureaucracy is removed (no need to vote just to set wages). While I still support a profitless economy, it should work within the confines of workers being able to negotiate their own wages.

The other stuff I wrote about pricing in the post still stands, however.

-

201903.27

Wealth is (mostly) a zero-sum game

I’d like to talk about wealth. I’ve heard many times from many different people that “wealth is not a zero-sum game.” I disagree.

Wealth is (mostly) a zero-sum game. I will argue that most “creations” of wealth are not actually creations, but instead diversions, and when someone talks of “creating” wealth, they usually mean diverting wealth.

Firstly, let’s distinguish wealth from money. I will define wealth (for our purposes “material wealth”) as the collection of all of one’s possessions that have monetary value in terms of exchange or use. This can be property, investments, money, stockpiles of food, weapons, etc. This is distinct from money because while money can be printed, wealth cannot. Wealth can gain or lose value without any exchanges happening because the market value of the items counted in wealth might change over time, however the loss of value of wealth for one person is generally a gain of wealth for another. For instance, printing money will raise the wealth of the agency printing it while lowering the value of the currency for those holding it (this is a diversion).

Secondly, let’s distinguish wealth from value. In many of the discussions I’ve had about wealth, “value” inevitably comes up. “Value was created.” Wealth encompasses things than have a value (for our purposes, a market value), however this is distinct from societal value, and people are speaking of societal value when they say “value was created.”

Third, let’s describe a market economy. An economy is a network. The nodes of the network are people, companies, or states, and the connections between nodes are transactions. Wealth moves and flows through our economic network like a series of rivers and streams. This network has inputs (things outside of it that feed into it) and outputs (things that are consumed). Creation of new wealth would be defined as an external input to the economic network that previously did not exist (the addition of a new input). All other changes to transactions in the network are diversions.

Inventions

Let’s start with inventions. Often, this is the first thing brought up when people speak of wealth being created. Let’s say I invent the first clock. It consists of a spring that’s wound to power the system mechanically, a set of gears, and a face with arms. The invention is a smashing success, and within a year I am swimming in wealth. Was wealth created? It would certainly seem so, if you were to only look at the individual node of the economic network representing me. That doesn’t explain where the wealth I’ve gained came from then. When I invented the clock, did the market value of one of my clocks suddenly show up in the bank account of everyone interested in buying the clock? No, it did not. Instead, the people who bought the clock found it more useful than something else they would have otherwise bought. In other words, my creation of the first clock did not create wealth, it merely diverted it. If you were to take a simplistic view, you could say that wealth was diverted from sundials. So while I have found new riches, the builders of sundials are perhaps wringing their hands at the very thought of me.

Now, an important distinction I brought up before: wealth and societal value are different! When I created the first clock, societal value was created. People can now tell time at night and they can tell time without owning a plot of land on which a sundial would have gone. I have created value (as in societal value) with my invention. I have not, however, created wealth. No new economic inputs appeared. I have instead diverted existing wealth from other nodes of the economic network to myself.

This applies to all inventions. Airplanes diverted wealth from trains. Cars diverted wealth from carriages, equestrian tradespeople, and barns. Computers diverted wealth (and continue to do so) from countless industries and professions. None of these things directly created new wealth (however, indirect wealth was created when the market demand for silicon skyrocketed in order to build computers).

Stock market

But the stock market! If I buy IBM at $10 and sell a year later for $15, wealth has been created!

Not really. In the simplistic view, people sold other stocks in order to purchase IBM. The stocks they sold are now worth less than before. Or perhaps someone decided to buy IBM’s stock instead of a second car. The car dealership lost a sale because your IBM stock went up.

Why, then, does the stock market keep trending up over time? Isn’t wealth being created? In some ways, yes. If a country has oil reserves, mining that oil has created wealth. This is not enough to explain the overall market growth, however. In essence, the stock market grows when people put money into it. So it follows that the stock market grows because more and more people are buying stocks. This can be seen as a diversion of wealth from outside the stock market as purchases into the stock market. This is, in essence, a growing concentration of wealth into the market, most probably caused by extractions of profit by those who are more inclined to invest:

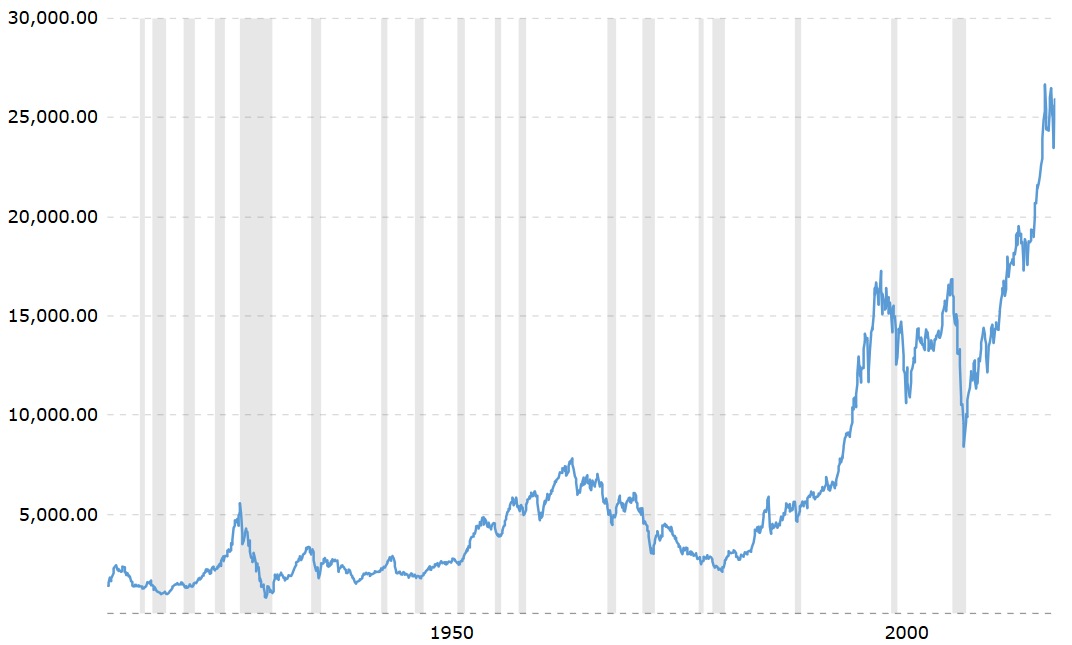

Here’s the Dow Jones over a 100-year period, inflation-adjusted. Notice the growth patterns before the 1990s: a peak in 1929 of $5.5K, a slightly higher peak in 1966 of $7.8K, then after 1996 explosive growth. This explosion happened right around the time of Clinton’s neoliberal policies encouraging hostile banking in foreign nations and relaxation of trade regulations. In a capitalist sense, this represented a new frontier. Wealth was not created, but diverted to the United States from developing nations.

Speaking of wealth and stock markets, the 2008 financial crisis is a wonderful example of what happens when people attempt to create new wealth. The government bailouts to banks ended up being a large diversion of wealth from taxpayers to greedy pricks.

Actual wealth creation

So why then is wealth a mostly zero-sum game? Because wealth can be created: mining resources, homesteading a previously uninhabited plot of land, and harnessing natural forms of energy (such as farming or solar and wind power).

The best case for wealth creation would likely be mining. Mining creates new economic inputs that were previously unusable, and some of these economic inputs have very high market value.

Also, new technologies can unlock economic inputs that were previously inaccessible. Invention of the offshore drilling rig allows oil extraction where previously infeasible. A device that allows humans to breath underwater indefinitely might allow homesteading of the ocean floor…what was once useless to humans (in the sense of monetary value) is now commodifiable. Or perhaps a space ship that can mine raw materials from Mars would result in the creation of new wealth.

However, in the case of creation of wealth, the wealth created (as in, the economic inputs added to the network) is miniscule to the other economic operations required. For instance with farming, you have to buy the machines to prepare the soil. You have to buy the seeds. You have to buy the watering infrastructure and the water. You have to hire the workers to help you. You have to pay taxes to fund the legal and military system that ultimately protects your land from hostile takeover. The amount of in-network economic transactions required to produce the new economic inputs (the input being food grown by the sun), are miniscule to the creations of economic inputs.

In reality, the few cases where wealth creation actually occurs are either hyper-competitive such that nobody is getting rich by participating (unless they own massive amounts of land and equipment), or they are exclusive to those who already have immense amounts of wealth.

Yes, wealth can be created (but not by you)

Wealth can be created. The creation takes place as an economic input that is either external (like the sun), locked away (under the Earth), or by new technology that allows the harnessing of either of those in order to produce new economic inputs. These new technologies are generally not immediately available to the general public, meaning creation of new wealth is controlled by those that have a critical mass of it already.

In essence, the amount of economic processes that create wealth are tiny compared to the amount of economic processes that are simply diversions of wealth, and unless you have a good heap of starting capital, you will not be creating wealth anytime soon.

For someone with a net worth of $500M, perhaps wealth can be created. For someone with a net worth of $100K, wealth cannot be directly created…only diverted, by convincing people who have wealth already to do so.

Wealth is (mostly) a zero-sum game.

Kill the radio (or die trying)

Hi, I'm Kay Lyon.

I'm working on Stamp, a p2p identity system used as the

foundations of other systems, like the upcoming version of Turtl

(a p2p encrypted, collaborative knowledge base) and Basis (the world's

favorite post-capitalist economic protocol).

Recent posts

- Stamp protocol: a p2p identity system

- The property "ownership" myth (and other thoughts on socialization)

- The Five Components of Economic Systems: A discovery through explorations of Socialism

- The mystification of pricing

- Wealth is (mostly) a zero-sum game

- How to really save Net Neutrality

- Debug comments (or how to save your sanity using git)

- Ansible: included handlers not running in v2.x

- Spam entry: We are expert